By early 2026, one conclusion from last year is hard to ignore: 2025 marked a turning point for Europe’s energy transition. Not because renewables stalled but because they finally became dominant enough to expose the next weak point in the system.

2025 did not expose a lack of ambition.

It exposed a lack of system thinking.

Across the EU, solar and wind delivered record amounts of electricity. Prices calmed compared to the crisis years. Fossil fuels continued their retreat. Yet beneath these successes, the power system showed visible strain. Volatility increased. Negative prices became routine. Grid operators spent more time firefighting than planning.

As the European Commission put it in its latest State of the Energy Union report, Europe’s electricity system has crossed a threshold: renewables are no longer an add-on, they are the backbone.

That shift changes everything. The main challenge is no longer how to build more clean generation. It is how to govern, stabilize, and integrate a system where clean power dominates and where generation is increasingly decentralized.

2025 – Success, with Side Effects

Solar’s Breakthrough Moment

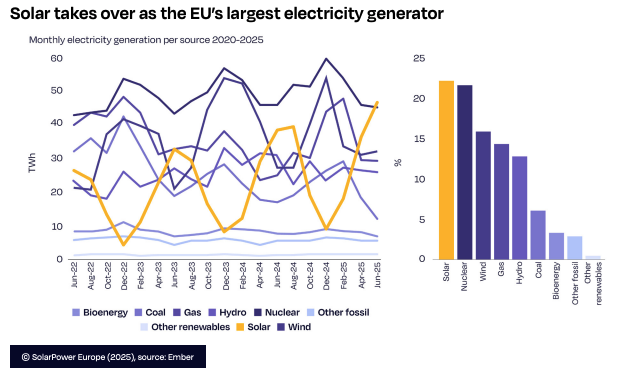

In June 2025, solar briefly became the EU’s largest electricity source on a monthly basis (Solar Power Europe Outlook Mid 2025). By the third quarter, renewables accounted for 49.3% of net EU power generation (European Commission, 2025).

This growth was not driven by a handful of new mega-projects. It was driven by millions of distributed installations from rooftop PV, small commercial systems to decentralized assets embedded deep in the distribution grid.

Wholesale prices reflected this abundance. Average prices in Q2 2025 hovered around €65/MWh, a far cry from the crisis levels of 2022 (European commission quarterly report volume 18). For consumers and industry, this was welcome relief.

But cheaper averages hid sharper swings. Prices increasingly collapsed at midday and rebounded steeply in the evening—an early warning sign of structural imbalance in a decentralized, weather-driven system.

Fossil Fuels Lose Their Grip

The decline of fossil fuels continued, both politically and economically. Russian gas fell to about 12% of EU supply by August 2025, down from 45% in 2021 (European Commission – energy report 2025). Lignite generation dropped another 13% year-on-year in Q2 (ENTSO-E data).

Investors followed the same logic. Roughly two-thirds of global energy investment in 2025 flowed into clean technologies rather than fossil fuels (World Economic Forum). This was not driven by idealism alone. It reflected risk, cost, and long-term competitiveness.

Too Much Power at the Wrong Time

By mid-2025, negative electricity prices were no longer exceptional. Across European markets, more than 4,400 hours of negative prices were recorded in Q2 alone (European commission quarterly report volume 18).

This was not failure. It was success colliding with an electricity system designed for centralized scarcity, not decentralized abundance.

Clean power was plentiful, but the system struggled to shift it in time and space. In countries like Sweden, with high renewable penetration, negative prices became almost routine.

In short: Europe did not lack electricity. It lacked flexibility and the ability to coordinate millions of decentralized assets.

The Real Shift: From Generation to Integration (2026–2030)

The lesson from 2025 is straightforward but uncomfortable. Adding more wind and solar without fixing integration does not solve the problem, it amplifies volatility. Insufficient investment in electricity networks is a major risk to the secure operation of power systems in high-renewables scenarios (World Energy Outlook 2024).

This integration challenge is inseparable from a deeper structural shift:

Europe’s power system is no longer centralized and predictable.

It is increasingly decentralized, weather-driven, and locally constrained.

That decentralization is not a problem to be reversed.

It is a feature that must be deliberately designed for.

The lesson from 2025 is not that Europe moved too fast on renewables.

It is that Europe underestimated what happens after success.

Integration not installation will define who remains competitive, who retains system stability, and who loses control over their energy system.

Europe’s Storage Reality Check

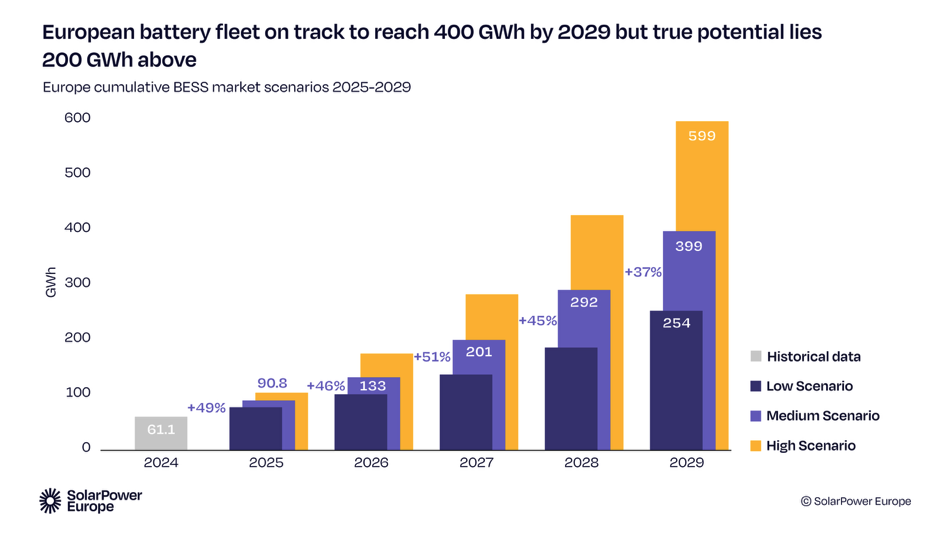

By 2024, Europe had installed around 61 GWh of battery storage (SolarPower Europe, Battery Storage Outlook 2025). That sounds impressive until it is compared with what a renewables-heavy, decentralized system actually needs.

High-renewables scenarios imply hundreds of gigawatts of storage power capacity by 2030, translating into several hundred gigawatt-hours of energy storage (IEA, Electricity Grids and Secure Energy Transitions). Current deployment rates are not yet aligned with that scale.

Two Very Different Storage Jobs

The data from 2025 makes a clear distinction:

- Short-duration storage handles daily solar swings, frequency control, and fast balancing close to where generation and demand occur. Lithium-ion remains dominant here, but sodium-ion batteries are emerging as a credible alternative for stationary use, with fewer critical raw materials (BloombergNEF, Battery Technology Outlook 2025).

- Long-duration storage addresses multi-day weather events—the Dunkelflaute problem. Lithium-ion struggles economically beyond 8–10 hours. This is where flow batteries, thermal storage, and other long-duration solutions start to matter (IEA, Long-Duration Energy Storage 2024).

These are not competing technologies. They solve different problems in a decentralized system.

Batteries Become Part of the Grid

Another shift became clear in 2025: batteries are no longer just market assets chasing price spreads. As fossil generators retire, grids lose physical inertia the stabilizing mass that keeps frequency steady.

Power systems dominated by inverter-based resources require grid-forming capabilities to remain stable(ENTSO-E System Needs Study 2025).

In a decentralized system, storage is no longer optional. It is quietly turning into core infrastructure.

What Matters Most on the Road to 2030

Flexibility Is Where Value Now Sits

The old idea of baseload is fading fast. The most valuable assets in today’s electricity system are those that can react instantly, charging when power is abundant and discharging when it is scarce. The widening price gap between midday oversupply and evening demand makes this clear. Markets alone will not solve this. Capacity mechanisms and system services must reflect the real value of flexibility, especially when it is delivered locally and in real time.

Decentralization Is the Operating Model

A high-renewables system is, by nature, decentralized. Millions of rooftop PV systems, batteries, EVs, and heat pumps are turning consumers into system participants.

The success of the transition will not be determined by how much decentralized generation exists but by whether it is visible, controllable, and integrated into system operations.

Decentralization without coordination creates chaos.

Decentralization with digital control becomes resilience.

Electrification Needs Coordination

Electric vehicles and heat pumps are rolling out fast (IEA, Global EV Outlook 2025). Done poorly, they increase peak demand. Done well, they become flexible, distributed system assets.

Smart charging and vehicle-to-grid are no longer “nice-to-haves”. They are auxiliary tools for managing decentralized demand and avoiding the next bottleneck.

Grids Decide the Pace

The European Commission estimates around €5.6 trillion in grid investment will be needed by 2050 in net-zero scenarios (Fit for 55 Impact Assessment). Permitting delays, local opposition, and fragmented planning already slow progress.

Without grids that are designed for decentralization, everything else stalls.

How Key Actors Must Act (2026–2035)

The transition into a high-renewables, decentralized system is no longer a question of ambition, but of execution.

1. How Companies Should Position Themselves

Electricity is no longer a passive input cost. It is a strategic variable.

- Treat flexibility as a balance-sheet asset

Invest in on-site batteries, flexible production processes, and energy management systems. - Move from fixed-price thinking to dynamic energy strategies

Combine long-term PPAs with short-term market exposure, storage, and demand response. - Integrate electrification with system awareness

Smart charging, thermal storage, and flexible processes must become standard practice.

In short, companies should stop asking “How much does electricity cost?” and start asking

“How flexible and how decentralized can we operate?”

2. How Energy Providers Must Adapt Their Business Models

Traditional volume-based supply models are eroding.

- Shift from energy sales to system services

- Invest in hybrid, distributed portfolios

- Act as flexibility orchestrators through aggregation and virtual power plants

Utilities that fail to evolve from commodity suppliers into system integrators risk structural margin erosion.

3. How Grid Operators Must Rethink Planning and Operations

The grid is now the critical bottleneck of the energy transition.

- Plan for variability, not averages

- Embed storage and power electronics as core grid components

- Accelerate digitalisation and real-time visibility

- Engage proactively with markets and regulators

The grid of the future is no longer a passive transport layer.

It is an active, digitally managed platform for coordinating decentralized energy.

Strategic Implication Across All Actors

The common thread is clear: flexibility, coordination, and system thinking are replacing scale and volume as the dominant success factors.

Actors that continue to optimise for yesterday’s centralized energy system—characterised by baseload generation, predictable flows, and static demand—will face higher costs, lower revenues, and growing operational risk.

Those that design for decentralization and volatility will define the next phase of the energy transition.

Conclusion: It’s not abundance but volatility

By the end of 2025, one thing was settled: Europe can build renewable power at scale and needs to By the end of 2025, one fact was no longer in doubt: Europe can build renewable power at scale and must continue to do so.

The next phase of the energy transition will not be decided by additional megawatts, but by how well time, place, and stability are managed. Storage, smart grids, and flexible demand are no longer supporting technologies. They are the mechanisms that determine whether a renewables-based system functions or fragments.

Europe’s next strategic vulnerability will not be a lack of energy resources.

It will be the failure to govern decentralized abundance.

In a power system dominated by renewables, sovereignty no longer comes from ownership of fuels in the ground. It comes from the ability to coordinate millions of distributed assets into a stable, responsive whole – technically, economically, and institutionally.

Those who master decentralization will define markets, protect competitiveness, and preserve political room for maneuver. Those who do not will discover that low prices alone do not create security.

Flexibility is the foundation of a secure clean energy system.

#EnergyTransition #RenewableEnergy #EnergyStorage #GridFlexibility #ElectricityMarkets #EnergyPolicy #Europe